Beyond Meat encountered stronger-than-expected headwinds in the second quarter as consumers resorted to less expensive animal proteins.

The US meat-free company’s sales fell short of analysts’ estimates, with Beyond Meat pointing to the general slowdown in the category and consumers pinched by the rise in the cost of living.

When results were reported in May for the first quarter, the Beyond Steak maker suggested that its cost-cutting programme was causing the company to “turn a corner”.

However, during a call with analysts yesterday (7 August), Beyond Meat chief executive Ethan Brown discussed how the category overall was suffering and that issues went beyond his company.

“I think the main issue with the category is not bringing in enough new consumers. That’s the number one issue. It’s not necessarily the characteristics of the consumer, it’s that the overall pie is not growing, and that’s what we need to fix together,” Brown said.

See Also:

Discussing the difficulties for meat-alternatives in times when consumers are spending less on proteins, Brown added: “But then you get to our category where we are high priced, and so not going to do particularly well in that environment.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBrown also said the US market was showing particular signs of slowing demand due to a misconception of the category on the whole and the environmental benefits of choosing plant-based meat-alternatives over animal-based counterparts.

While Beyond Meat is reviewing its pricing – as price cuts were not successful last year – to address demand issues, aggressive spending to reduce the price gap with conventional meat is not the answer in the US market right now, Brown suggested.

“Doing a lot of continued discounting, whether it’s us or a major competitor, we’re just trading among consumers, so it’s not productive.”

Beyond Meat’s priority, aside from generating efficiencies, is addressing the “ambiguity and confusion” around the health benefits of plant-based meat, he said.

“There is a considerable gap between the strong health credentials of our products and a broader counter-narrative that is now afoot, and this gap appears to have widened.”

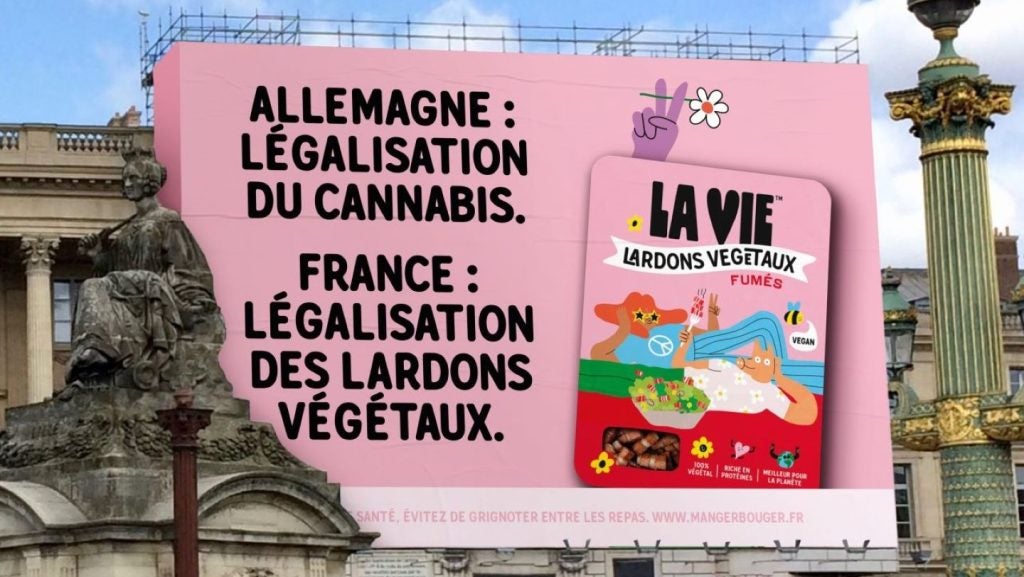

Brown noted that Europe told a different story, where consumers are “very concerned about climate and the environment”.

“Europe is different than it is here in the US. Consumers are very concerned about climate and the environment in Europe, government is concerned about it, and institutions are concerned about it. Here in the US, it [plant-based consumption] is more driven by health and there’s been a decline in the health perception of our category… We now have to do the heavy work as an industry to fix that,” he said.

Brown added: “The ark of history is very much on the side of what we’re trying to accomplish. And even if all of these other things don’t get cleared up, which they will, around health, etc, you have a climate crisis, which is now becoming more and more real for the consumer. And there is really no way to get at that without fixing food.”

Nevertheless, the company forecast 2023 revenue between $360m and $380m, compared to its prior expectation of $375m to $415m.

Beyond Meat's quarterly net revenue fell almost 31% to $102.1m year-on-year, short of consensus analysts’ estimates of 5.6%, according to AllianceBernstein.

US net revenue for the period fell 40.1% to $61.2m, while Beyond Meat’s international sales only fell 8.7% to $40.9m.

Adjusted EBITDA was a loss of $40.8m, compared to a loss of $68.8m in the year-earlier period.